Good morning everyone,

here are the new IRPEF rates for the current fiscal year, 2024, already operational.

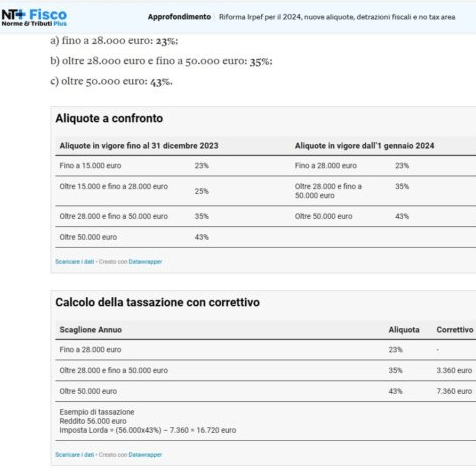

Here is the table of the new rates that we take from the publication Norme e Tributi del Sole 24 Ore:

We compare the tax differences due to the new IRPEF rates for taxable incomes of, for example, €25,000, €50,000 and €100,000 with those previously in force.

New rates:

Old rates:

The taxes calculated with the new IRPEF rates for incomes of €25,000, €50,000 and €100,000, without considering any deductions due based on the individual position, are:

The taxes with the old rates are:

Let's see a comparison:

| Taxable income | New Tax (€) | Old Tax (€) | Difference (€) |

|---|---|---|---|

| €25.000 | 5.750 | 6.150 | -400 |

| €50.000 | 14.140 | 15.320 | -1.180 |

| €100.000 | 35.640 | 36.820 | -1.180 |